|

3년전 500만원 목돈이 생긴 친구가 주식하고 싶다고 찾아 왔기래. 한국주식할래 미국주식 할래? 물어보았는데. 나보고 어느 나라주식하냐고 하길래 나는 미국주식한다고 하니 친구따라 강남간다고 친구도 미국주식하고 싶다. 친구는 미국주식 아는게 없다고 나에게 사달라고 하여. 휴대폰 증권앱에서 500만원 환전시키고 이것저것 매수 해주었는데 3년 지나고 보니 폭망했군요. ㅠㅠ

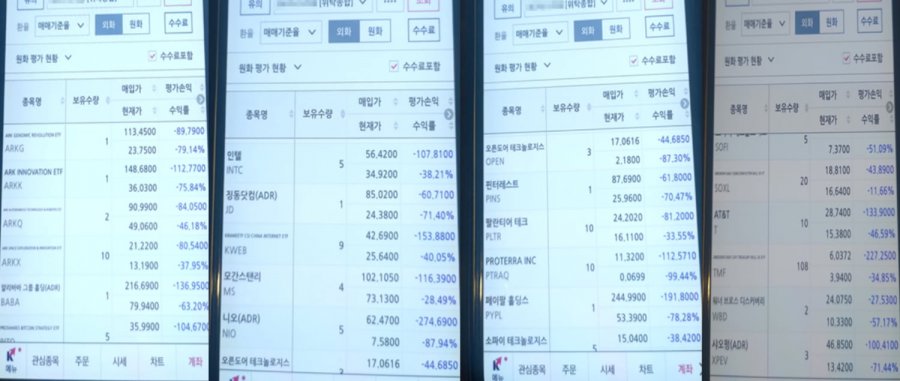

친구 미국주식3년차-현재 보유중인 21종목 미국주식 잔고와 손실종목&마이너스 수익률 인증

친구에게 추천한 종목과 이유들-

1. ARKG–79.14% 2.ARKK–75.84% 3.ARKQ–46.18% 4.ARKX–37.95%--돈나무 언니 캐시우드 열풍에 따라 사봄(고점매수 망함)

5. BITO—비트코인1억간다는 뉴스에36달러근처에 매수 망함.현재가15.09달러–58%

6. INTC(인텔)-AMD에 밀리고 애플에서 퇴출되고 악재로 결과 망함–38.21%

7. JD(징동닷컴)—중국의 아마존이 될거라는 환상에 젖어 매수-결과망함–71.40%

8. KWEB (KraneShares CSI China Internet ETF)-중국이 코로나 벗어나면 좋을 것 같아 매수-망함–40%

9. MS(모간스탠리)-미국에 가장 큰 투자은행이라 매수했지만 망함–28.49%

10. NIO(니오)-중국의 테슬라라 될거라고 믿고 매수했지만 망함–87.94%

11. OPEN(오픈도어)-한국아파트 값이 폭등하니 미국 부동산 역시 잘될라고 믿고 매수 망함-87.3%

12. PINS(핀터레스트)-제2의 페이스북이 될거라고 보고 매수 망함–70.47%

13. PLTR(팔란티어)-빅테이타에 최고의 기술력을 가졌다고하여 폭망-35.55%

14. PROTERR(프로테라)-전기차 버스 만드는 회사라 하여 매수 폭망-99.44%

15. PYPL(페이팔)-전자결제 시스템에 최고라 하여 매수 망함-78.28%

16. SOFI(소파이)-한국의 카뱅처럼 될거라고 매수 망함-51.09%

17. SOXL(반도체3배레버리지)-매수후 20달러 넘어 갔지만 매도못하여 그나마 조금 손실중-11.66%

18. T(AT&T)-한국SK텔레콤처럼 안정적일거라 매수했지만 망함-46.59%

19. TMF-미국채권3배 레버리지ETF-금리 계속올라 망함-34.85%

20. WBD(워너브라더스)-T분할로 무상으로 받았는데 현재-57.17%

21. XPEV(샤오펑)중국전기차 제2의 테슬라는 꿈꾸며 매수 망함-71.4%

현재 보유한 전체 21개 종목 올 마이너스 이네요. ㅠㅠ

반성합니다.

|

등록안내

등록안내 등록안내

등록안내

와우...정말 유명한 qqq spy 애플은 안하셨네요...

QQQ.SPY 금액이 높아 매수 못하고. 애플은 조금 수익내고 팔았습니다.